Bariga Aasiya waxay had iyo jeer ahayd xudunta cufisjiidadka soo saarista baytariyada lithium-ion, laakiin Bariga Aasiya gudaheeda xudunta cuf-isjiidadka waxay si tartiib tartiib ah ugu sii jeedday Shiinaha horaantii 2000-meeyadii.Maanta, shirkadaha Shiinuhu waxay hayaan jagooyin muhiim ah silsiladda sahayda lithium-ka caalamiga ah, labadaba kor iyo hoosba, taas oo ka dhigan qiyaastii 80% wax soo saarka unugyada batteriga illaa 2021.1 Fidinta qalabka elektiroonigga ah ee macaamiisha sida taleefannada gacanta iyo laptops-yada ayaa kor u qaaday qaadashada baytariyada lithium-ion sanadihii 2000-yadii , iyo hadda 2020-meeyadii isbeddel caalami ah oo loogu talagalay gawaarida korontada (EVs) ayaa dabaysha gelinaysa shiraacyada baytariyada lithium-ion.Fahamka shirkadaha lithium-ka Shiinaha ayaa sidaas darteed muhiim u ah fahamka waxa awood u leh kor u qaadista la filayo ee soo socota ee korsashada EV.

Xarunta Cufis-jiidadka waxay u wareegtay dhanka Shiinaha

Guulo badan oo Nobel Prize-ka ah ayaa horseeday in la iibiyo baytariyada lithium-ka, gaar ahaan Stanley Whittingham 1970-yadii iyo John Goodenough 1980-kii. Inkastoo isku dayadani aysan si buuxda u guulaysan, waxay dhulka u dhigeen horumarkii muhiimka ahaa ee Dr. Akira Yoshino ee 1985, kaas oo laga dhigay baytariyada lithium-ion kuwa badbaado leh oo ganacsi ahaan shaqayn kara.Halkaa wixii ka dambeeyay, Japan ayaa tartankii ugu horreysay ku lahayd iibinta baytariyada lithium-ka iyo kor u kaca Kuuriyada Koonfureed ayaa ka dhigtay Bariga Aasiya xarunta dhexe ee warshadaha.

Sannadkii 2015-kii, Shiinuhu waxa uu ka sare maray Kuuriyada Koonfureed iyo Japan si uu u noqdo dhoofiyaha ugu sarreeya ee baytariyada lithium-ion.Koritaankan waxaa ka danbeeyay dadaallo siyaasadeed iyo hal-abuurnimo geesinnimo leh.Laba shirkadood oo aad u da'yar, BYD iyo Contemporary Amperex Technology Company Limited (CATL), waxay noqdeen raad-raacyo waxayna hadda ka yihiin ku dhawaad 70% awoodda batteriga Shiinaha.2

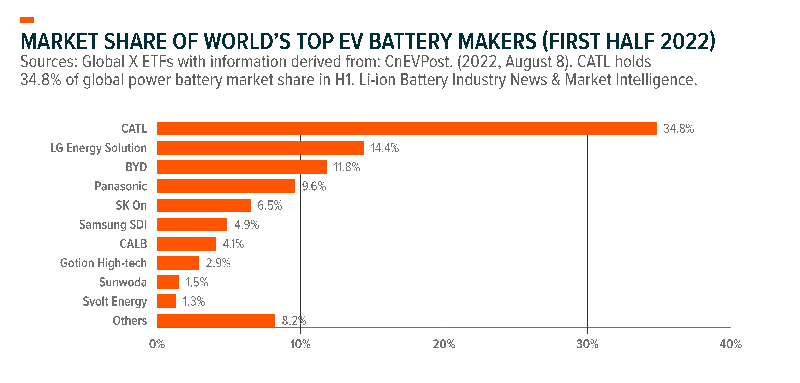

Sannadkii 1999-kii, Injineer lagu magacaabo Robin Zeng ayaa ka caawiyay helitaanka Amperex Technology Limited (ATL), kaas oo turbo kor u qaaday kobociisa 2003dii isagoo heshiis la galay Apple si uu u sameeyo baytariyada iPod.Sannadkii 2011, hawlaha batteriga EV ee ATL waxaa lagu soo rogay Shirkadda Amperex Technology Company Limited (CATL).Qaybtii hore ee 2022, CATL waxay qabsatay 34.8% suuqa baytariyada caalamiga ah.3

Sannadkii 1995 kii, farmashiye magaciisa la odhan jiray Wang Chuanfu ayaa u jihaystay koonfurta Shenzhen, si uu u aasaaso BYD.Guushii hore ee BYD ee warshadaha lithium-ka waxay ka timid baytariyada soo saarista taleefannada gacanta iyo elektiroonigga macaamiisha iyo iibka BYD ee hantida go'an ee Beijing Jeep Corporation waxay calaamadisay bilawga safarkeeda booska baabuurta.2007dii, horumarka BYD wuxuu qabsaday indhaha Berkshire Hathaway.Dhammaadkii qeybtii hore ee 2022, BYD waxa ay dhaaftay Tesla iibka caalamiga ah ee EV, inkastoo ay la timid digniinta ah in BYD ay iibiso EV-yada saafiga ah iyo kuwa isku-dhafka ah, halka Tesla ay diiradda saarto kaliya EVs.4 saafi ah.

Kor u kaca CATL iyo BYD waxaa caawiyay taageero siyaasadeed.Sannadkii 2004tii, baytariyada lithium ayaa markii ugu horraysay galay ajendaha siyaasad-dejiyeyaasha Shiinaha, iyadoo leh "Siyaasadaha lagu horumarinayo warshadaha baabuurta," ka dibna 2009 iyo 2010 iyada oo la hirgeliyay kabidda baytariyada iyo xarumaha dallaca ee EVs.5 Intii lagu jiray 2010-kii, nidaam. Kaalmada waxaa la siiyay $10,000 ilaa $20,000 baabuurta korantada, waxaana loo diyaariyay oo keliya shirkadaha ku shira baabuurta Shiinaha ee leh baytariyada lithium-ion ee alaab-qeybiyeyaasha Shiinaha ee la ansixiyay. Batteriga Shiinaha ayaa sameeya doorashada soo jiidashada badan.

Korsashada EV ee Shiinaha ayaa kicisay Baahida Lithium

Hoggaanka Shiinaha ee korsashada EV waa qayb ka mid ah sababta baahida caalamiga ah ee baytariyada lithium ay kor u kacayaan.Laga bilaabo 2021, 13% baabuurta lagu iibiyo Shiinaha waxay ahaayeen isku-dhafan ama EVs saafi ah waxaana tiradaas la filayaa inay korodho.Kobaca CATL iyo BYD ee galangal caalami ah labaatan sano gudahood ayaa soo koobaysa firfircoonida EVs ee Shiinaha.

Markay EVs korodhay, baahida ayaa ka sii wareegaysa baytariyada nikkel-ku-salaysan oo dib ugu laabanaya baytariyada birta ku salaysan (LFPs), kuwaas oo mar hoos u dhacay helitaanka cufnaanta tamar yar (sidaa darteed baaxad hoose).Si ku habboon Shiinaha, 90% wax soo saarka unugyada LFP ee adduunka oo dhan waxay ku saleysan yihiin Shiinaha.7 Habka ka beddelashada nikkel-ku-saleysan LFP maaha mid adag, sidaa darteed Shiinuhu wuxuu si dabiici ah lumin doonaa qayb ka mid ah qaybtiisa goobtan, laakiin Shiinaha ayaa u muuqda si kastaba ha ahaatee. meel fiican u taagan si ay u ilaaliso booska ugu weyn ee booska LFP mustaqbalka la filayo.

Sanadihii la soo dhaafay, BYD waxa ay hore ugu sii wadaysay baytarigeeda LFP Blade Battery, kaas oo si weyn kor ugu qaadaya batteriga badbaadada batteriga.Iyada oo la adeegsanayo qaab dhismeed batari cusub oo wanaajinaya ka faa'iidaysiga booska, BYD ayaa daaha ka qaaday in baytariga Blade kaliya aanu dhaafin tijaabada ciddiyaha gelitaanka, laakiin heerkulka dusha sare ayaa sidoo kale ahaa mid qabow ku filan sidoo kale. baabuurta, baabuurta waaweyn sida Toyota iyo Tesla ayaa sidoo kale qorsheynaya ama horeyba u isticmaalaya Battery Blade, inkastoo Tesla qaar ka mid ah hubanti la'aantu ay weli tahay inta.9,10,11

Dhanka kale, bishii Juun 2022 CATL waxay soo saartay baytarigeeda Qilin.Si ka duwan Battery Blade kaas oo ujeedadiisu tahay in uu wax ka beddelo heerarka badbaadada, batteriga Qilin waxa uu si aad ah u kala soocaa cufnaanta tamarta iyo waqtiyada dallacaadda. kuwaas oo muujinaya koboca baaxada leh ee farsamada ka dambeeya baytariyadan.13,14

Shirkadaha Shiinuhu waxay Sugaan Booska Istaraatiijiyadeed ee Silsiladda Supplyta ee Caalamiga ah

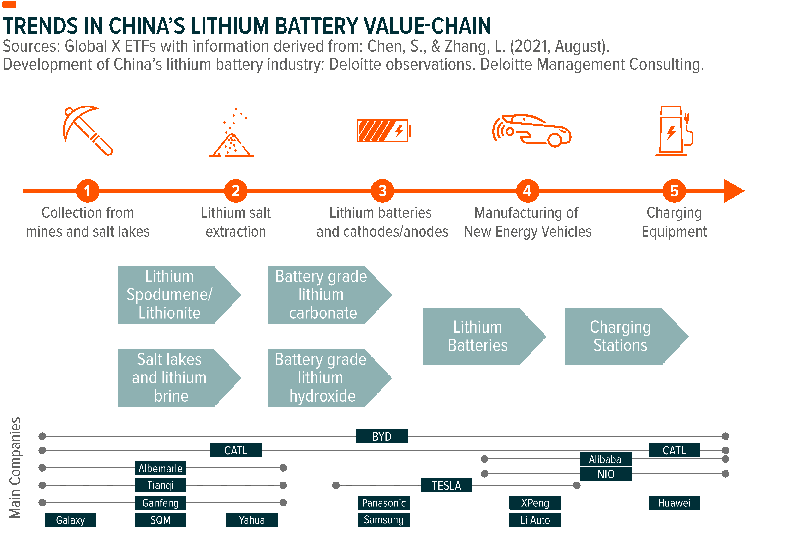

In kasta oo shaqada CATL iyo BYD ee booska EV ay muhiim tahay, joogitaanka weyn ee Shiinaha ee qaybaha sare waa in aan daruuri la illoobin.Qaybta libaax ee wax soo saarka lithium ceyriin waxay ka dhacdaa Australia iyo Chile, kuwaas oo leh saami caalami ah 55% iyo 26%.Dhinaca sare, Shiinuhu waxa uu kaliya 14% ka yahay wax-soo-saarka lithium-ka caalamiga ah.15 Iyadoo ay taasi jirto, shirkadaha Shiinuhu waxay samaysteen joogitaanka sare ee sannadihii la soo dhaafay iyada oo loo marayo iibsashada saamiyada macdanta adduunka oo dhan.

Xajmiga wax iibsiga waxaa wada kuwa batteriga sameeya iyo macdan qodayaasha si isku mid ah.Tusaalayaal dhowr ah oo xusid mudan 2021 waxaa ka mid ah Zijin Mining Group oo $765mn ku iibsatay Tres Quebradas iyo CATL $298mn oo ay ku iibsatay Bariga Cauchari iyo Pastos Grandes, labadaba Argentina.16 Luulyo 2022, Ganfeng Lithium waxay ku dhawaaqday qorshaheeda inay ku hesho 100% Lithea Inc. Argentina oo qiimaheedu dhan yahay 962 milyan oo dollar.

Kaydinta Tamarta waxay muujinaysaa suurtagalnimada caqabadaha deegaanka

Ballanqaadyada Shiinaha ee ah in la gaaro qiiqa ugu sarreeya 2030 iyo dhexdhexaadnimada kaarboon 2060 waa qayb ka mid ah waxa keenaya baahida loo qabo korsashada EV.Waxyaabaha kale ee muhiimka ah ee guusha himilooyinka la cusboonaysiin karo ee Shiinaha waa qaadashada tignoolajiyada kaydinta tamarta.Kaydinta tamarta waxay la socotaa mashaariicda tamarta dib loo cusboonaysiin karo waana sababta dhabta ah ee dawlada Shiinaha ay hadda u xilsaarayso 5-20% kaydinta tamarta si ay ula socdaan mashaariicda tamarta la cusboonaysiin karo.Kaydinta ayaa muhiim u ah in la yareeyo, taas oo ah hoos u dhigista ula kac ah ee wax soo saarka korontada sababtoo ah baahida ama dhibaatooyinka gudbinta, ugu yaraan.

Kaydinta biyaha la shubay ayaa hadda ah isha ugu weyn ee kaydinta tamarta oo leh 30.3 GW ilaa 2020, si kastaba ha ahaatee ku dhawaad 89% kaydinta aan hydro-ga ahayn waxa loo maraa baytariyada lithium-ion.18,19 baytariyadu waxay ku habboon yihiin kaydinta muddada gaaban, taas oo ka badan waxa loo baahan yahay dib-u-cusboonaysiinta.

Shiinuhu hadda waxa uu haystaa oo keliya 3.3GW ee awoodda kaydinta tamarta batteriga, laakiin waxa ay leedahay qorshayaal ballaarin ballaadhan.Qorshayaashan ayaa si faahfaahsan loogu qeexay Qorshaha Kaydka Tamarta ee Shanta Sano ee 14-aad oo la soo saaray March 2022.20 Mid ka mid ah ujeedooyinka ugu waaweyn ee qorshahan ayaa ah in la dhimo kharashka halbeeg kasta ee kaydinta tamarta 30% marka la gaadho 2025, taas oo ogolaanaysa kaydinta. si ay u noqdaan doorasho dhaqaale ahaan la jecel yahay.21 Intaa waxa dheer, sida qorshaha ku jira, State Grid waxay rajaynaysaa inay 100GW ku kordhiso awoodda kaydinta baytariga 2030 si ay u taageerto kobaca la cusboonaysiin karo, taas oo ka dhigi doonta kaydinta baytariyada Shiinaha kuwa ugu weyn adduunka, inkastoo ay ka horreeyaan oo kaliya Maraykanka oo la saadaalinayo inuu haysto 99GW.22

Gabagabo

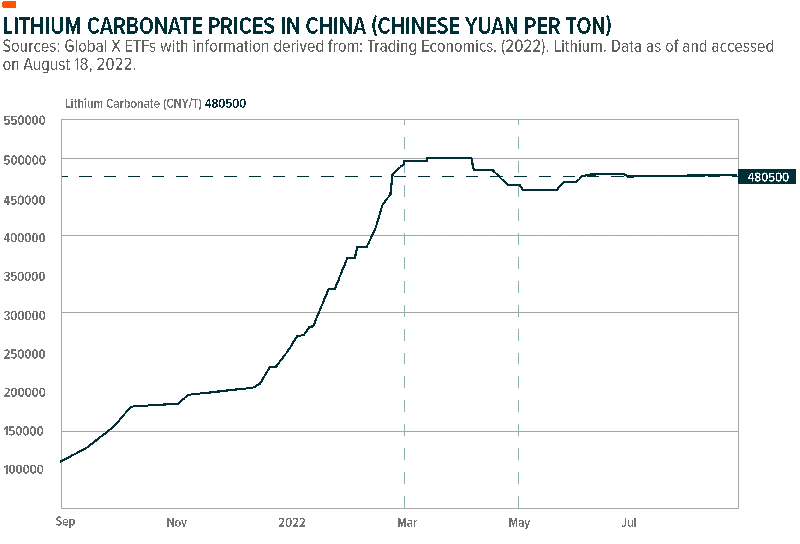

Shirkadaha Shiinuhu waxay mar hore beddeleen silsiladda sahayda lithium-ka caalamiga ah, laakiin waxay ku sii wadaan inay si xawli ah u curiyaan.Marqaati u ah muhiimada ay ku leeyihiin warshadaha, laga bilaabo Aug 18, 2022, shirkadaha Shiinaha waxay sameeyeen 41.2% Solactive Lithium Index, taas oo ah index loogu talagalay inay la socdaan waxqabadka shirkadaha ugu waaweyn iyo kuwa dareeraha ah ee firfircoon ee sahaminta iyo /ama macdanta lithium-ka ama soo-saarka baytariyada lithium-ka.23 Caalamka, qiimaha lithium-ku wuxuu kordhay 13-laab intii u dhaxaysay July 1, 2020 iyo July 1, 2022, ilaa $67,050 halkii ton.24 Shiinaha, qiimaha lithium carbonate per ton ayaa kor u kacay. laga bilaabo 105000 RMB ilaa 475500 RMB intii u dhaxaysay Agoosto 20, 2021 iyo Aug 19, 2022, taas oo muujinaysa korodhka 357%.25 Iyada oo qiimaha lithium carbonate uu kor u kacay ama ku dhow yahay heerar taariikhi ah, shirkadaha Shiinaha ayaa si dabiici ah u jooga meel ay ka faa'iidaystaan.

Isbeddelkan ku yimid qiimaha lithium-ka ayaa ka caawiyay saamiyada Shiinaha iyo Mareykanka ee la xiriira baytariyada iyo lithium-ka in ay ka sarreeyaan tusmooyinka suuqa ee kacsan iyadoo ay jiraan xaalado suuqeed oo xun;Intii u dhaxaysay Agoosto 18, 2021 iyo Aug 18, 2022, MSCI China All Shares IMI Select Battery Index ayaa soo celiyay 1.60% ka dhanka ah -22.28% MSCI China All Shares Index.26 Dhab ahaantii, kaydka batteriga Shiinaha iyo batariyada alaabada ayaa ka sarreeya saamiyada lithium ee caalamiga ah, Sida MSCI China All Shares IMI Select Battery Index ayaa dib u soo celiyay 1.60% marka loo eego Solactive Global Lithium Index soo celinta -0.74% isla muddadaas.27

Waxaan aaminsanahay in qiimaha lithium-ku uu sare u kici doono sanadaha soo socda, isaga oo u dhaqmaya sidii dabayl madaxeed oo suurtagal ah samaynta baytariyada.Si kastaba ha ahaatee, waxaan rajeyneynaa,hagaajinta farsamada baytariga lithium waxay ka dhigi kartaa EVs labadaba la awoodi karo oo hufan, taas oo iyana kor u qaadi karta baahida lithium.Marka la eego saameynta Shiinaha ee silsiladda sahayda lithium-ka, waxaan fileynaa in shirkadaha Shiinaha ay u badan tahay inay door muhiim ah ka ciyaari doonaan warshadaha lithium sanadaha soo socda.

Waqtiga boostada: Nov-05-2022